Debt Advisory

Stay in control

of your funding

Bankbrokers support your debt financing project to ensure a flexible, fair and balanced solution. Based on your individual credit profile, strategic priorities and the prevailing market conditions.

Funding due

diligence

Establish a road-map

for your funding

programme

Debt structure

design

Align your debt structure

with your strategic

ambitions

Borrower

presentation

Improve your

attractiveness in a lenders

perspective

Debt

arrangement

A competitive funding

process with you in the

drivers seat

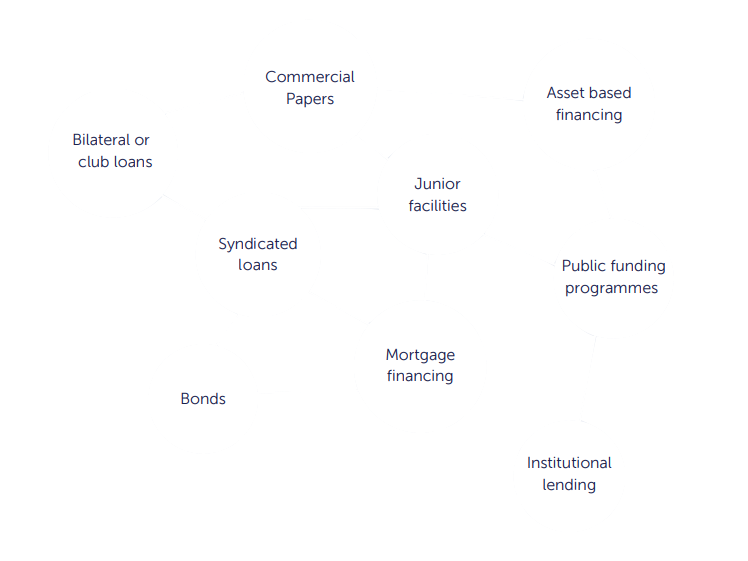

A jungle of debt

instruments

There is an abundance of funding opportunities

available in the market, and more and more

investors are moving into the corporate lending space.

Should you issue a bond instead of seeking traditional

bank financing? Do you need to syndicate your

funding across several banks? Is export credit

financing relevant for you?

We help you navigate the various opportunities

and guide you on thepros and cons of the many

alternatives.

Funding due diligence

Establish a road-map for your funding

programme

A review of your current funding arrangements will enable you to plan and prioritise future initiatives.

Our funding due diligence compares your current solutions with common market practice and your individual financial

characteristics. We spot possible inconveniences and “red flags”. And we help you plan timing of refinancing and costs of refinancing

Debt structure design

Align your debt structure with your strategic

ambitions

No more “off-the-shelf” solutions… Instead we design a tailormade debt structure based on your individual credit profile, your

strategic priorities and your debt capacity.

We analyse which debt instruments are best suited for you. And terms and conditions such as pricing, tenor, covenants,

required exceptions and basket sizes will be modeled to suit your priorities and maximise your financial flexibility.

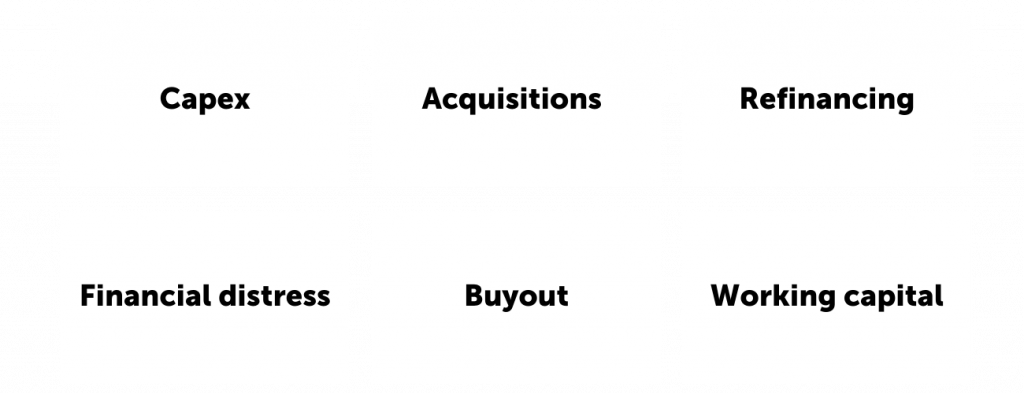

Common

financing triggers

Bankbrokers’ financing experts can help you with

a tailormade and optimised financing solution,

regardless of your situation and needs.

Are you facing one of the mentioned scenarios?

Borrower presentation

Improve your attractiveness from a lenders

perspective

A detailed corporate and credit presentation will maximise your appeal to the market, and helps you control the narrative.

We supply lenders with everything from a company profile description and business risk assessment to your financial base

case. And we produce the necessary financial analysis including a selective focus on relevant aspects.

Debt arrangement

A competitive funding process with you in the

drivers seat

Tap into our extensive experience in arranging and negotiating financing facilities.

Leave preparation and negotiation of your term sheet to our independent experts instead of your funding providers. We

cherrypick the preferred, potential lenders from our strong international network. And we support you in the negotiation of

loan documentation in collaboration with a local, reputable law firm.

Debt Advisory

Case Studies

Our dedicated team has helped many companies optimise their funding structure. Whether it be simple, domestic lease financing, factoring solutions or large, international, syndicated facilities, we always create value through our unbiased approach, our international network and our vast experience.

Our

Services

We support our clients in all areas of banking and merchant services. Whether you want to reduce costs, optimise payment solutions or need support with debt financing, Bankbrokers is your trusted, international and independent partner.

Benchmarking & Renegotiation

We help you reduce the costs of banking and merchant services through improved pricing and optimised solutions.

Merchant Services Advisory

We help you reduce the costs of banking and merchant services through improved pricing and optimised solutions.

Debt Consultancy

We help you to meet your vusiness goals, by ensuring you have a flexible, fair and tailored funding structure in place.

Get Inspired

Follow our newsletter to stay up-to-date on banking and merchant services