Cost Analysis & Optimisation

Full transparency and reduced costs

We shine a light across the maze of banking and merchant services to increase transparency,

reduce complexity, and improve value for money.

Our Benchmarking & Renegotiation

Services

Our in-depth knowledge, backed by our robust data analytics, allow us to go beyond broad-brush benchmarking to reduce the costs of banking and merchant services, strengthen relationships and deliver tailored solutions for all our clients.

Cost analysis

Lack of transparency and opaque pricing are undesirable elements of banking and merchant services. We identify all costs and calculate your provider’s net income the same way your provider does.

Benchmarking

Our unrivalled, international database and our passion for data-driven analytics enable us to benchmark your terms against the market and identify potential savings.

Tailored solutions

Our unbiased recommendations and access to all products and services across the entire market means we will secure tailored and cost-efficient solutions for you.

Renegotiation

With experience from countless negotiations, we guide you safely through renegotiations with your current providers to realise the

potential savings.

Our unique

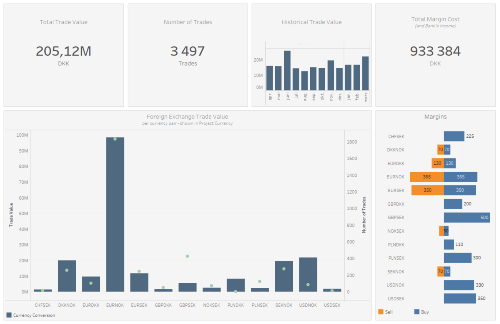

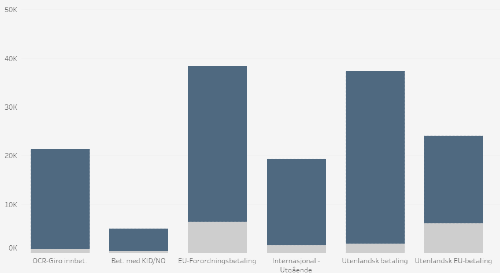

Analysis tool

Visual and interactive

As part of Bankbrokers’ benchmarking and renegotiation service, we include access to our unique analysis tool called Insights, a highly interactive and visual tool that allows you to explore your banking and/or merchant services data in a whole new way. From high-level overviews to detailed views, Insights increases transparency of your company’s banking and merchants services related costs.

Actionable insights

Our Insights tool delivers actionable insights. Your data is benchmarked against our comprehensive database, and together with analyst input allows us to highlight any pricing or product inefficiencies of your current provider(s). The result is transparent output and clear recommendations.

Want to see Insights in action?

Our efficient

Process

Being well organised and streamlined is essential for a swift and hassle-free service delivery. We have refined our processes over more than a decade and continue to do so as we learn from each project. But we also know that no two projects are the same, which is why we’ll be flexible to meet your precise needs.

Data Extraction

We review your contracts and access your current transactions / charges for the last 12 months (we can obtain the data directly from your providers if that’s easier)

Analysis – Part 1

We play-back our understanding of your current arrangements for verification. This then forms the basis of the benchmark

Analysis – Part 2

We benchmark your prices against our extensive database, identify potential savings and then agree your preferred next steps

Renegotiation

We collaborate with you on the renegotiations for better terms from your current providers (no need to change providers unless you want to)

Realise Savings

We only invoice our success fee once we’ve secured the savings for you. We offer flexible and competitive pricing options to meet your needs

Cost Analysis & Optimisation

Case Studies

Whether it be global cash management, foreign exchange, invoice financing or payments, we always provide full transparency, detailed analysis and maximum value for money.

Our

Services

We support our clients in all areas of banking and merchant services. Whether you want to reduce costs, optimise payment solutions or need support with debt financing, Bankbrokers is your trusted, international and independent partner.

Merchant Services

Advisory

We help you reduce the costs of banking and merchant services through improved pricing and optimised solutions.

Benchmarking &

Renegotiation

We help you reduce the costs of banking and merchant services through improved pricing and optimised solutions.

Debt consultancy

We help you to meet your business goals,

by ensuring you have a flexible, fair and

tailored funding structure in place.